Down Payment Assistance Programs Can Help Pave the Way to Homeownership

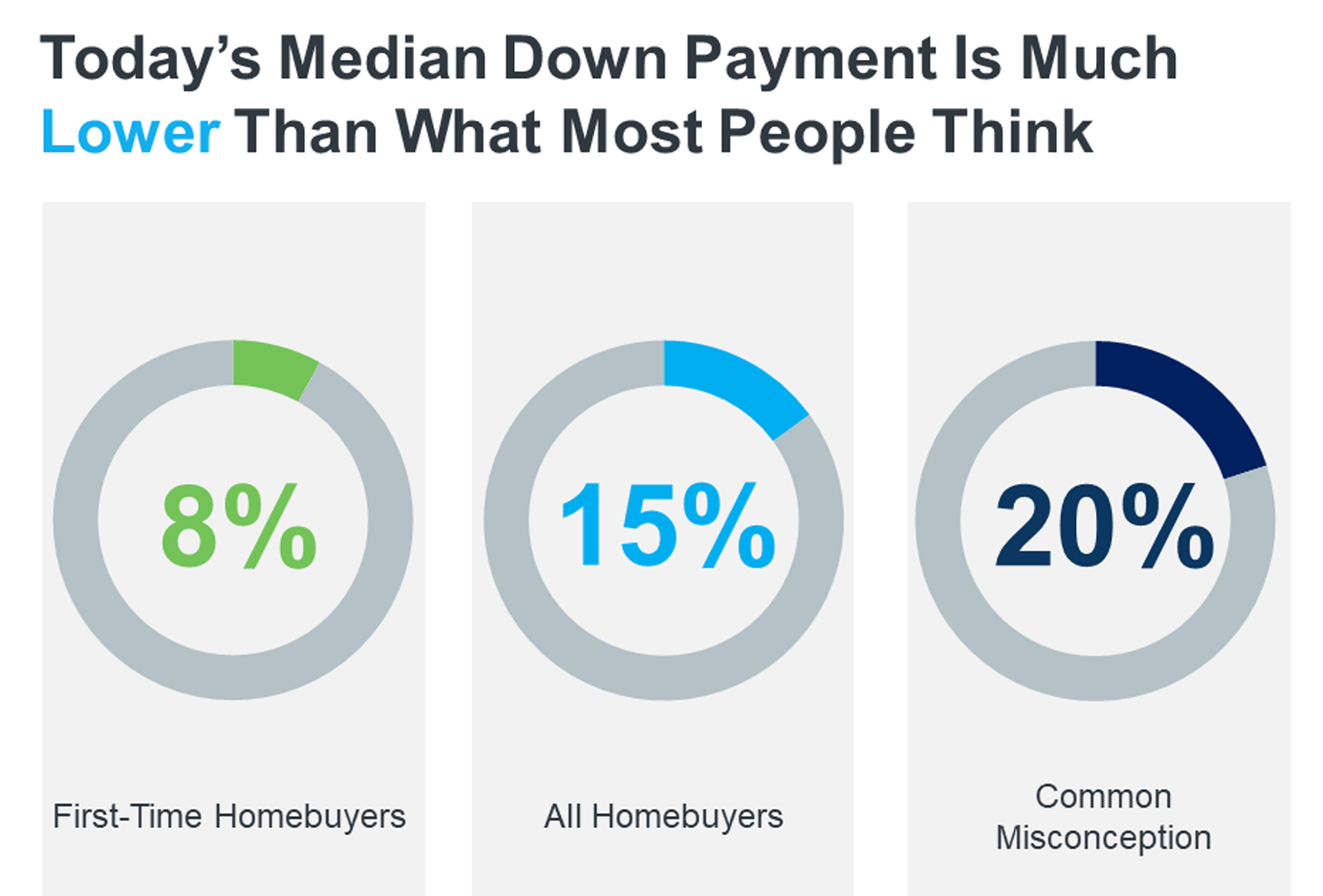

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think:

Data from NAR shows the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 15%. And it’s even lower for first-time homebuyers at 8%. But just because that’s the median, it doesn’t mean you have to put that much down. Some qualified buyers put down even less.

For example, there are loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. But let’s focus in on another valuable resource that may be able to help with your down payment: down payment assistance programs.

First-Time and Repeat Buyers Are Often Eligible

According to Down Payment Resource, there are thousands of programs available for homebuyers – and 75% of these are down payment assistance programs.

And it’s not just first-time homebuyers that are eligible. That means no matter where you are in your homebuying journey, there could be an option available for you. As Down Payment Resource notes:

“You don’t have to be a first-time buyer. Over 39% of all [homeownership] programs are for repeat homebuyers who have owned a home in the last 3 years.”

The best place to start as you search for more information is with a trusted real estate professional. They’ll be able to share more information about what may be available, including additional programs for specific professions or communities.

Additional Down Payment Resources That Can Help

Here are a few down payment assistance programs that are helping many of today’s buyers achieve the dream of homeownership:

- Teacher Next Door is designed to help teachers, first responders, health providers, government employees, active-duty military personnel, and veterans reach their down payment goals.

- Fannie Mae provides down-payment assistance to eligible first-time homebuyers living in majority-Latino communities.

- Freddie Mac also has options designed specifically for homebuyers with modest credit scores and limited funds for a down payment.

- The 3By30 program lays out actionable strategies to add 3 million new Black homeowners by 2030. These programs offer valuable resources for potential buyers, making it easier for them to secure down payments and realize their dream of homeownership.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that ease the path to homeownership by providing support with down payments and other associated costs.

Even if you don’t qualify for these types of programs, there are many other federal, state, and local options available to look into. And a real estate professional can help you find the ones that meet your needs as you explore what’s available.

Bottom Line

Achieving the dream of having a home may be more within reach than you think, especially when you know where to find the right support. To learn more about your options, let’s connect.

Don’t Fall for the Next Shocking Headlines About Home Prices